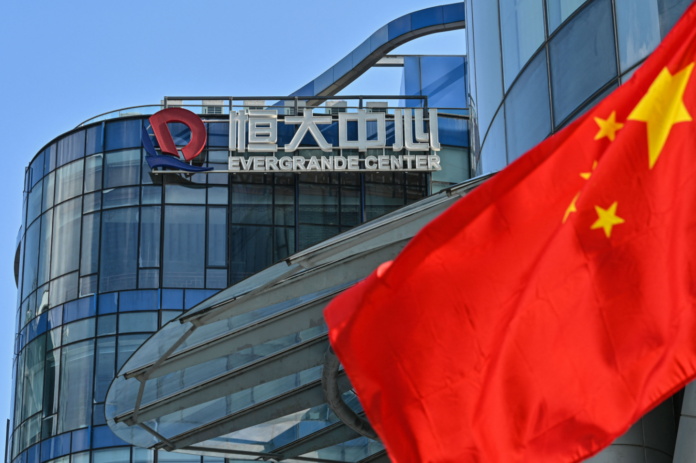

Buckle up, finance fanatics, as we dive into the turbulent journey of China Evergrande Group. Once the poster child for China’s real estate ambitions, valued at an eye-popping $50 billion in 2017, the company’s stock plunged a whopping 87% recently, earning the undesirable “penny stock” badge. Now, the beleaguered property titan sits at a diminished market value of roughly $586 million.

But what precipitated this freefall? After a 17-month trading hiatus, Evergrande’s shares saw daylight again, only to be greeted by the market’s ruthless selloff. The hiatus ended on a somber note: the company’s internal control mechanisms finally aligned with the listing criteria of the Hong Kong exchange.

If that didn’t rattle investors enough, Evergrande’s financial revelations did. A staggering loss of 33 billion yuan for the six months leading to June 30 only amplified the woes from the preceding two-year 582 billion yuan loss. By the time the dust settled on the first half of 2023, Evergrande’s net loss tally stood at an alarming 39.3 billion yuan.

Now, Evergrande isn’t alone in its struggles. A wave of economic challenges threatens to swamp China, with the property sector at the heart of this tempest. Real estate behemoths like Country Garden are also navigating the treacherous waters of surging debt and bankruptcy threats.

Drawing parallels with historic financial events, some pundits are raising alarms about a potential “Lehman moment” in China. However, economic analysts strike a more nuanced chord, pointing out that China’s situation isn’t a mirror image of the US 2008 crisis, largely due to inherent differences in political and economic structures.

But let’s not breathe easy just yet. William Hurst, an expert from the University of Cambridge, offers a chilling perspective. Reflecting on the US property market crash in 2008, he notes that the present crisis in China is potentially operating on a larger scale with far graver consequences, given the massive wealth concentrated in China’s real estate sector.

So, where do we go from here? For investors and global watchers alike, it’s a tale of caution, resilience, and, most importantly, adaptation. The fall of giants like Evergrande underscores the ever-evolving landscape of global finance. Staying informed and vigilant might just be the need of the hour.