Berkshire Hathaway recently reduced its stake in Chinese electric vehicle (EV) maker BYD for the 11th time in under a year, just days before Warren Buffett and Charlie Munger expressed their reluctance to compete with Elon Musk.

The sale of nearly 2 million shares leaves Berkshire holding just under 10% of BYD, currently valued at just over $3 billion. BYD is a prominent competitor to Tesla, the world’s largest EV manufacturer.

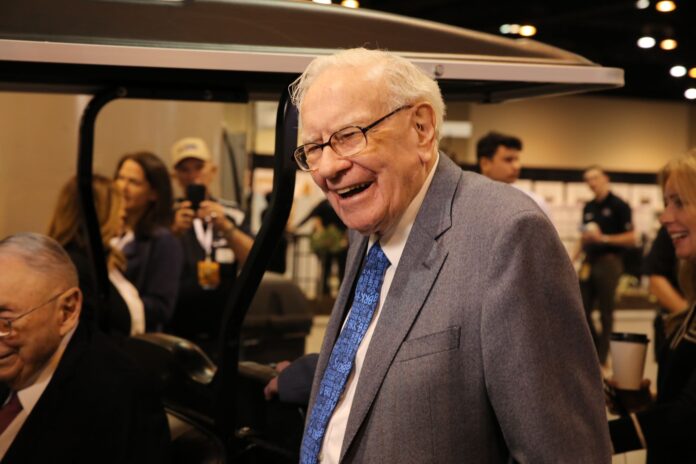

At Berkshire’s annual shareholder meeting, Buffett and Munger were asked if they think Elon Musk overestimates himself. They acknowledged Musk’s immense talent, calling him a “brilliant mind” who has achieved remarkable success, possibly because he overestimates his abilities. Munger praised Musk’s penchant for tackling impossible tasks and achieving them.

However, the exact reason for Berkshire’s decision to reduce its stake in BYD remains uncertain, as competition with Musk’s Tesla could be only one of several factors. The conglomerate may simply be taking profits to redeploy the cash elsewhere, such as in Occidental Petroleum.

Buffett has also expressed concerns about the heightened geopolitical tensions between China and Taiwan, which led him to sell his stake in Taiwan Semiconductor just a few months after acquiring it. These geopolitical risks could extend to a Chinese auto manufacturer like BYD.

For entrepreneurs and investors who follow Berkshire Hathaway, this development presents an opportunity to evaluate the potential implications of the reduced BYD stake and the possible reasons behind it. As the EV industry continues to grow, understanding the motives and strategies of market leaders can inform investment decisions and business strategies.